Contrary to claims by cheerful news sources, Social Security’s deficit outlook is not “unchanged” or “no worse.” Social Security’s unfunded obligation rose by $1 trillion according to the latest trustees’ report.

U.S. taxpayers now owe $12.3 trillion to pay scheduled benefits—in addition to what Social Security can hope to collect from payroll taxes—over the 75-year horizon. That’s $98,517 for every household in America today.

But who can blame news sources for merely citing Treasury Secretary Jack Lew, who summarized the report in this bright light:

The projections in this year’s report for Social Security are essentially unchanged from last year.

The reported unfunded obligation for the combined Social Security old age, survivors, and disability insurance (OASDI) program rose from $8.6 trillion in 2011 to $9.6 trillion in 2012. The $1 trillion increase represents a 12 percent deterioration in OASDI’s funding outlook.

“Essentially unchanged,” huh?

But even this figure excludes $2.7 trillion in IOUs owed to the Social Security trust fund, and adding it in brings the total unfunded obligation to $12.3 trillion. The entire debt held by the public is $11.9 trillion—a $1 trillion in increase in the debt limit would be no big deal then either, would it?

As my colleague Rachel Greszler and I explain, the trust fund IOUs represent real debt that when redeemed will need to be paid by raising taxes or borrowing from the public (future taxes):

It is true that the Social Security trust fund represents legitimate repayments plus interest, but this distinction has no bearing on the federal budget’s bottom line. Imagine a family that sets aside money for a child’s college education but then borrows all of that money for other spending. Once the time for college arrives, the family will have to scramble to pay tuition because the IOUs in the college account represent money the family must pay itself.

So it is with Social Security’s trust fund. Congress spent all the excess revenues when Social Security was running surpluses, and now repaying those revenues is adding to deficits.

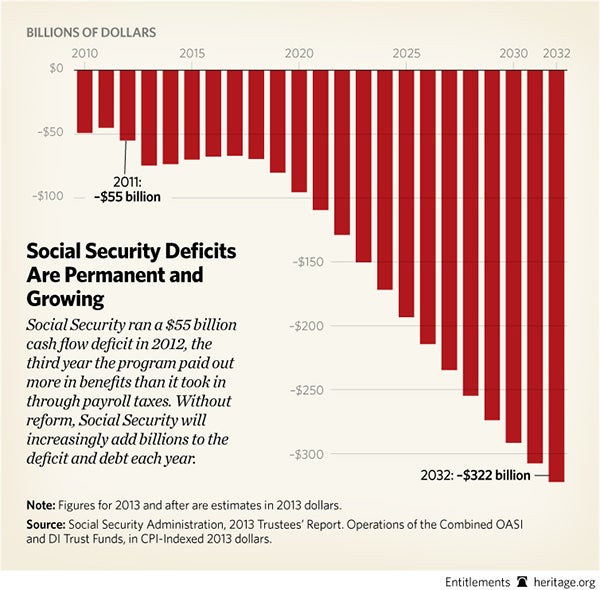

Social Security is in its third year of running cash-flow deficits, and the 2012 gap between revenue raised from payroll taxes and benefits paid was $55 billion. But this is merely the beginning as Social Security cash flow deficits are projected to double in less than 10 years, and continue growing from there.

Social Security is already adding to deficits today, and its unfunded obligations threaten to burden younger generations with higher taxes and debt. Reform is urgent and necessary to ensure Social Security’s sustainability and protect its most vulnerable populations from automatic benefit cuts at trust fund exhaustion in less than 20 years.

And for the record, a $1 trillion increase in current or future debt is a big deal to the American taxpayer—even if the President’s treasury secretary thinks otherwise.