Many middle-class Americans will be harmed by the design of Obamacare’s cost-sharing subsidies for lower-income exchange enrollees. Though relatively little attention has been given to this feature, understanding it is crucial to accurately projecting the results of its implementation.

Heritage Foundation Senior Fellow Ed Haislmaier has studied this feature of the bill and found that its effects will be unattractive for many Americans.

How do these cost-sharing subsidies work? Haislmaier explains that

they only apply to Silver plans…[that] are paid directly to the insurer, without the enrollee knowing the amount…. Thus, different individuals can purchase the same plan for the same, nominal premium, while, based on their different incomes, ending up with different deductible and co-pay levels for their coverage.

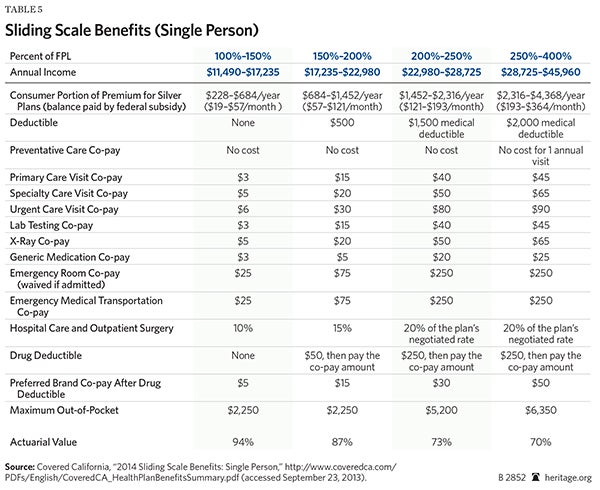

Table 5 illustrates those effects:

An enrollee with an income of 400 percent of the FPL [federal poverty level] will be responsible for paying $364 a month for the reference plan (the second-lowest-cost Silver plan), while an enrollee with an income of 100 percent of the FPL has to only pay $19 a month for the same coverage. The federal government pays the difference (if any) between those amounts and the plan’s premium to the insurer as a premium subsidy.

But it doesn’t stop there; cost-sharing provisions of various plans will also be adjusted based on the enrollee’s annual income:

[A]n enrollee with an income of 400 percent of the FPL will have a $2,000 deductible and be charged a $45 co-pay for each doctor visit, while an enrollee at 100 percent of the FPL will have no deductible and be charged only $3 for each doctor visit—even though both enrollees bought the same plan.

Haislmaier points out that there is an inherent problem with this design:

[W]hen the government pays insurers to lower cost sharing to the point that some patients are charged less than the price of a sandwich for a visit to the doctor, and calling an ambulance could be cheaper than calling a taxi, insurers know that their only recourse is to limit their plans to covering a smaller group of low-cost providers.

That means that this subsidy design is going to hurt, not help, a sizable portion of middle-class Americans.

Haislmaier concludes:

Because Obamacare’s cost-sharing subsidy design essentially forces insurers to adopt more limited provider networks for at least the Silver-plan level of exchange coverage, those plans will be less attractive to enrollees with incomes between 250 percent and 400 percent of the FPL—as they do not benefit from reduced cost sharing and also get much less in premium subsidies.

Enrollees with incomes between 300 percent and 400 percent of the FPL will likely seek coverage elsewhere, because the subsidies for them in the exchange are relatively small. This is just one more reason to replace this unworkable health care law with real solutions.

Louis Phillips is currently a member of the Young Leaders Program at The Heritage Foundation. For more information on interning at Heritage, please click here.